UDB Targets New Funding Initiatives Amidst Stellar Performance

Uganda Development Bank’s (UDB) gross loan disbursements in the year 2023 grew by 21 percent while its total assets rose by 8 percent in a year marked with a rollout of new initiatives towards supporting the private sector.

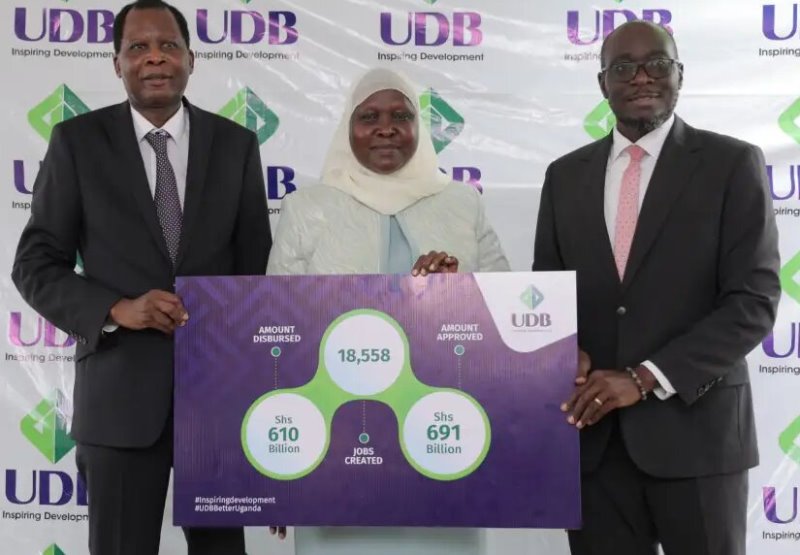

During the year 2023, the Bank approved funding amounting to Shs691 billion to support 201 projects across the country.

The country’s national Development Finance Institution Wednesday released its 2023 (unaudited results) indicating an 8% growth in assets from Shs1.52 trillion in 2022 to Shs1.64 trillion last year.

This growth was driven by the increase in gross loans to customers, which inched up by 24 percent to close the period at Shs1.6 trillion.

“During 2023, we delivered a strong set of results, consistent with the performance trend over the last couple of years, and in line with our role as the country’s Development Finance Institution,” said Patricia Ojangole, the UDB Managing Director.

“The Bank continues to make progress on its strategy implementation, fulfilling our primary mandate of generating tangible development outcomes that propel the country’s socio-economic progress. We remain resolute on carefully balancing these efforts with the need to be a financially sustainable institution,” she added.

Ojangole further reported a slight uptick of 5 percent in borrowing and grants, reaching Shs245 billion from Shs232 billion in December 2022. At least Shs466.5 billion was collected in loan repayments and reinvested to fund disbursements to various enterprises during the year.

In the same year, actual funds disbursed amounted to Shs610 billion to various projects across the country. Industry took the lion’s share accounting for Shs391 billion and representing 65 percent of the total disbursements, while primary agriculture accounted for Shs38.5 billion, representing 6 percent, and the balance was disbursed to finance other sectors including infrastructure and services including health, education, and tourism.

UDB has continued to make significant strides towards facilitating Uganda’s socio-economic development. On this front, 18,558 jobs are expected to be created through the approved projects on top of generating Shs11.39 trillion in additional output value, Shs615.96 billion in tax revenue to the Government, and Shs3.3 trillion in foreign revenue earnings.

To enhance development in the underserved segments of the country including the SMEs, Youth, and Women, the Bank continues to effectively implement several strategies dubbed special programs, specifically tailor-made to support their development.

In 2024, the Bank is poised to solidify the gains achieved and remains committed to advancing its ambition of supporting private sector enterprises addressing crucial societal needs. The objective is to amplify our impact in enhancing the quality of life for the people of Uganda.